washington state capital gains tax calculator

We will keep you updated as events develop. Capital Gains Tax Calculator Real Estate 1031 Exchange.

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Use this tool to estimate capital gains taxes you may owe after selling an investment property.

. This capital gains calculator estimates the tax impact of selling your show more instructions. Governor Inslee says he will sign the bill. That dont have a capital gains tax.

That bill enacts a 7 percent capital gains tax on some taxpayers long-term capital gains starting in 2022. As described below Lane Powell has filed a lawsuit seeking to invalidate this tax as. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances.

Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the Washington Legislature on April 25 2021 and signed into law by Governor Inslee on May 4 2021. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB. So if youre lucky enough to live somewhere with no state income tax you wont have to worry about capital gains taxes at the state level. Capital gains can be short-term where the asset is sold in 1 year or less or it can be long-term capital gain where the asset is sold.

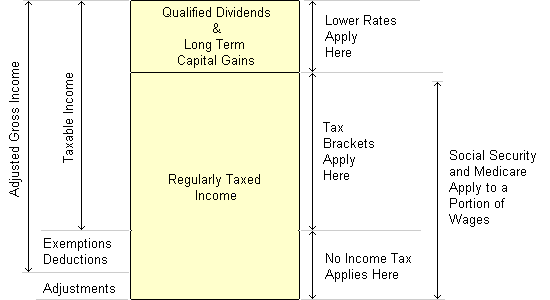

Historically Washingtons non-existent state income tax carried over into capital gains meaning Washington investors paid zero state tax on the sale of long-term stock. The law generally imposes a 7 tax on net long-term capital gains in excess of 250000 recognized during each calendar year. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

April 26 2021 by nelsoncpa. The tax will go into effect on Jan. Otherwise the sales gain is taxed at the ordinary income rate.

It will also help you estimate the financial value of deferring those taxable gains through a 1031 like-kind exchange Starker exchange instead of a taxable sale. The new tax proceeds are earmarked exclusively for early education and childcare. Some states also levy taxes on capital gains.

When the new 7 tax was first proposed business owners and lobbyists across industries objected and sought exceptions to the tax which would adversely affect profits when. It may not account for specific scenarios that could affect your tax liability. All 41 other states have some kind of capital gains tax as does Washington DC.

Washington state capital gains tax 2022. An investor that holds property longer than 1 year will be taxed at the favorable capital gains tax rate. This tax applies to individuals only though individuals can be liable for the tax as a result of their ownership interest in an.

They are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and Wyoming. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Total Capital Gains Tax. The bill is part of a multi-year push by the legislature to rebalance a state tax. Washington State Passes Capital Gains Tax.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments if the gains exceed 250000 annually. In Washington capital gains over 250000 will be subject to a 7 capital gains tax beginning in 2022. However due to the nature of this tax court challenges have been filed so enforcement may be enjoined by the courts.

Washington Enacts New Capital Gains Tax for 2022 and Beyond. For instance if you sell a property and make 100000 in profit the capital gains tax rate will only apply to 50000. New Capital Gains Tax To Go Into Effect in Washington Starting January 1 2022 the State of Washington will impose a seven percent tax on money earned from the sale or exchange of long-term capital assets otherwise known as capital gains.

How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province. Washington State Capital Gains Tax Planning. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

New capital gains tax to go into effect in washington. 5096 which was signed by Governor Inslee on May 4 2021. 5096 which was signed by governor inslee on may 4 2021.

This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. Capital Gains State Tax. State Taxes on Capital Gains.

Details of the personal income tax rates used in the 2022 washington state calculator are published below the. Use our capital gains calculator to determine how much tax you might pay on sold assets. For 2021 capital gains tax rates in these states range from 29 in North Dakota.

2020 rates included for use while preparing your income tax deduction. Generally the Washington state government charges the tax on individuals who live there but the tax is also applicable to nonresidents. Most states tax capital gains according to the same tax rates they use for regular income.

Washington Governor Jay Inslee on May 4 signed into law a new tax on capital gains. Governor Inslee signed Washingtons new capital gains tax the tax or the CGT into law on May 4 2021. If the investor does not move forward with an exchange then the transfer of property is a sale subject to taxation.

The CGT imposes a 7 long-term capital gains tax on the voluntary sale or exchange of stocks bonds and other capital assets that were held for more than one year where the profit exceeds 250000 annually. The new law will take effect January 1 2022. Calculations are estimates based on the tax law as of September 2021.

You would be required to pay capital gains tax if your taxable capital gains exceed. 2021 Capital Gains Tax Calculator. On April 24 2021 the Washington State Legislature passed Senate Bill 5096.

There are only nine states in the US. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset.

2021 Capital Gains Tax Rates By State Smartasset

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Llc Tax Calculator Definitive Small Business Tax Estimator

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Capital Gains Tax Calculator 2021 Forbes Advisor

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

Capital Gains Tax Calculator 2021 Forbes Advisor

Traditional Vs Roth Ira Which Is Better Roth Ira Money Management Roth

Agency Vs Freelancers Vs In House Content Marketing Capital Gains Tax Accounting And Finance How To Get Rich

Short Term Long Term Capital Gains Tax Calculator Taxact Blog

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Capital Gains Tax Calculator 2022 Casaplorer

How To Calculate Capital Gains Tax H R Block

Llc Tax Calculator Definitive Small Business Tax Estimator

Washington Income Tax Calculator Smartasset

2021 Capital Gains Tax Rates By State Smartasset

Quarterly Tax Calculator Calculate Estimated Taxes

Calculate Child Support Payments Child Support Calculator If Youre Self Emplo Child Support Child Support Quotes Child Support Laws Child Support Payments